Rmd Table 2025 Inherited Ira To Roth

Rmd Table 2025 Inherited Ira To Roth - 2025 Rmd Requirements Bride Clarita, Inheriting an ira comes with tax implications. Roth iras only have a rmd requirement once the original roth ira owner dies and the roth ira passes to the beneficiary(ies). Rmd Calculation Table For Inherited Ira, See roth ira contribution limits for tax years 2018 and 2019. If you inherited a roth ira then the same rules generally apply—you must take rmds.

2025 Rmd Requirements Bride Clarita, Inheriting an ira comes with tax implications. Roth iras only have a rmd requirement once the original roth ira owner dies and the roth ira passes to the beneficiary(ies).

While you never have to withdraw money from your own roth ira, an inherited roth ira requires beneficiaries to take distributions.

Rmd Calculation Table For Inherited Ira, The rollovers are subject to the annual roth ira contribution limit (in 2025 this limit is $7,000, plus an additional $1,000 for taxpayers who are age 50 and older). Never one to make things easy, the irs has proposed regulations (from february 2022) that added a second requirement for beneficiaries who inherit iras from those who died after reaching.

Inherited Roth Ira Rmd Rules 2025 Chris Delcine, Roth iras only have a rmd requirement once the original roth ira owner dies and the roth ira passes to the beneficiary(ies). While roth ira owners are not required to take withdrawals during their lifetime, beneficiaries are subject to rmd rules.

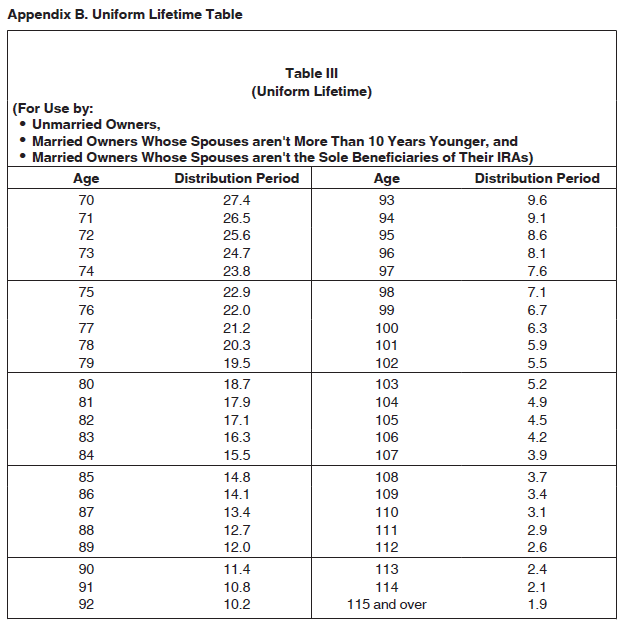

Note that 2025 rmds due by april 1, 2025, are still required. You will use this table if you are the spouse beneficiary who set up an inherited ira and whose deceased spouse would have been age 72 or older.

Inherited Roth Ira Rmd Rules 2025 Chris Delcine, You will use this table if you are the spouse beneficiary who set up an inherited ira and whose deceased spouse would have been age 72 or older. If you inherited a roth ira then the same rules generally apply—you must take rmds.

2025 Rmd Table Irs Viv Ronnica, Before 2020, if you inherited an ira and you were a designated beneficiary, you could do what was called a stretch ira, or an extended. Learn how much you can contribute based on your income.

Rmd Tables For Ira Matttroy, If you inherited a roth ira then the same rules generally apply—you must take rmds. Before 2020, if you inherited an ira and you were a designated beneficiary, you could do what was called a stretch ira, or an extended.

Rmd Table 2025 Inherited Ira To Roth. Roth iras don't require rmds while the account holder is alive. There is a big difference if you are.

Roth iras only have a rmd requirement once the original roth ira owner dies and the roth ira passes to the beneficiary(ies).

Rmd Calculation Table For Inherited Ira, There is a big difference if you are. The rules governing rmds are simpler for inherited roth iras, partly because roths don't have rbds.

Rmd Table For Inherited Roth Ira Matttroy, Most roth ira beneficiaries must take a lump sum. Roth iras only have a rmd requirement once the original roth ira owner dies and the roth ira passes to the beneficiary(ies).

The rollovers are subject to the annual roth ira contribution limit (in 2025 this limit is $7,000, plus an additional $1,000 for taxpayers who are age 50 and older).

2025 Rmd Inherited Ira Deina Eveline, While you never have to withdraw money from your own roth ira, an inherited roth ira requires beneficiaries to take distributions. Learn how much you can contribute based on your income.