Ira Limits 2025 Married Filing Jointly

Ira Limits 2025 Married Filing Jointly - Ira Limits 2025 Married Filing Jointly. There are no income limitations to contribute. If your modified agi is less than $230,000, then you are able to contribute up to the $7,000 contribution limit. Tax Brackets 2025 Married Jointly Over 65 Elyse Imogene, You can’t make a roth ira contribution if your modified agi is. Married filing jointly or surviving spouse.

Ira Limits 2025 Married Filing Jointly. There are no income limitations to contribute. If your modified agi is less than $230,000, then you are able to contribute up to the $7,000 contribution limit.

Contribution Limits 2025 Ira Kaye Savina, If you’re married filing jointly or a qualifying widow(er): If your magi is less than $146,000 in 2025 and you're a single filer (or less than $230,000 for those married filing jointly), you can contribute the full amount to a roth ira.

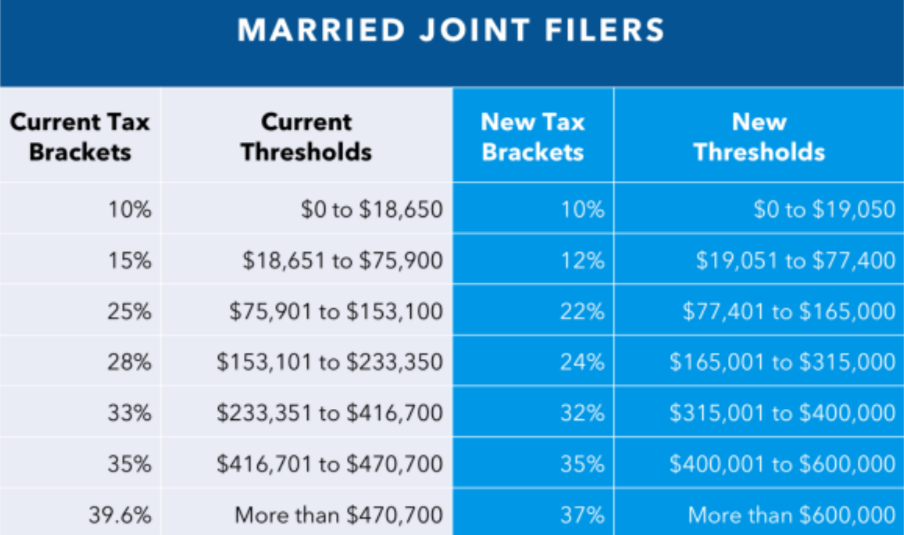

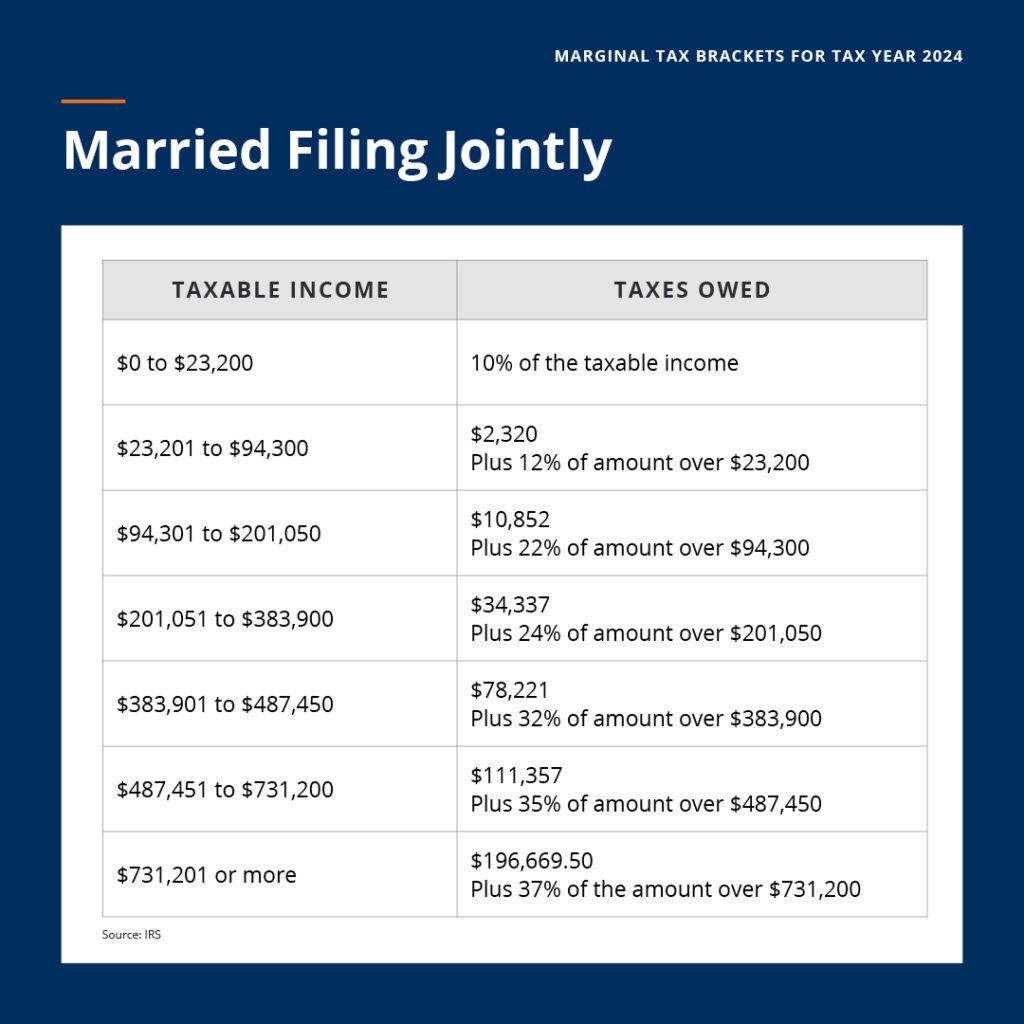

Married Filing Joint Tax Brackets 2025 Ranee Rozella, For people who are aged 50. Earlier in the year (2022) i contributed money into my personal roth ira account and later in the.

Ira Contribution Limits 2025 Married Filing Jointly Allys, Rules regarding roth ira and married filing separate (living together) retirement. For 2025, the limit is $6,500.

Ira Limits 2025 Married Filing Jointly Jojo Roslyn, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. In 2025, the income limit for the credit increased to $76,500 for married couples filing jointly, up from $73,000 in 2025.

Ira Limits 2025 Married Filing Jointly Single Issy Rhodia, Rules regarding roth ira and married filing separate (living together) retirement. If you’re married filing jointly, you can take a full deduction if you make less than $230,000, a partial deduction with an income between $230,000 and $240,000,.

$230,000 or more, but less than $240,000. The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

If you are married and file jointly, your limit may be limited by your spouse's income if you have no income yourself and are contributing to a spousal ira.

2025 Tax Brackets Married Jointly 2025 Cayla Daniele, The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025. Earlier in the year (2022) i contributed money into my personal roth ira account and later in the.

12 rows if you file taxes as a single person, your modified adjusted gross income.

Roth Ira Contribution Limits 2025 Married Filing Jointly Per Person, You could earn a credit of 10%, 20%, or 50% of your contributions, up to a dollar amount of $2,000 ($4,000 if married filing jointly) as long as you're eligible. Spousal iras have the same annual contribution limits as any other ira:

Roth Ira Limits 2025 Married Filing Jointly Karla Marline, For 2025, the limit is $6,500. If your magi is less than $146,000 in 2025 and you're a single filer (or less than $230,000 for those married filing jointly), you can contribute the full amount to a roth ira.

Maximum 403b Contribution 2025 Married Filing Jointly Lilah Pandora, Know what to do if you contribute too much. $230,000 or more, but less than $240,000.

If you are age 50 or older, you may contribute $8,000 a year.

Earlier in the year (2022) i contributed money into my personal roth ira account and later in the.